All Categories

Featured

Table of Contents

The payment may be spent for growth for an extended period of timea single premium postponed annuityor invested for a brief time, after which payout beginsa solitary costs prompt annuity. Single costs annuities are commonly moneyed by rollovers or from the sale of a valued asset. An adaptable costs annuity is an annuity that is planned to be funded by a collection of repayments.

Owners of repaired annuities know at the time of their purchase what the value of the future capital will certainly be that are generated by the annuity. Certainly, the variety of money flows can not be understood beforehand (as this relies on the contract proprietor's lifespan), yet the assured, repaired rate of interest a minimum of gives the proprietor some level of certainty of future income from the annuity.

While this difference seems straightforward and simple, it can significantly affect the worth that an agreement owner inevitably originates from his or her annuity, and it develops significant uncertainty for the agreement proprietor - Retirement savings with annuities. It additionally usually has a product influence on the degree of fees that an agreement owner pays to the issuing insurance provider

Set annuities are often used by older capitalists who have actually limited assets yet who intend to offset the risk of outliving their assets. Fixed annuities can function as an effective device for this objective, though not without specific drawbacks. In the case of prompt annuities, when an agreement has been bought, the agreement proprietor gives up any and all control over the annuity possessions.

Decoding Fixed Annuity Vs Equity-linked Variable Annuity Everything You Need to Know About Fixed Index Annuity Vs Variable Annuity Defining Annuity Fixed Vs Variable Advantages and Disadvantages of Annuity Fixed Vs Variable Why Deferred Annuity Vs Variable Annuity Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Annuities Variable Vs Fixed FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Index Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

For instance, a contract with a typical 10-year surrender period would charge a 10% abandonment fee if the contract was given up in the very first year, a 9% abandonment charge in the 2nd year, and so on until the surrender charge gets to 0% in the agreement's 11th year. Some postponed annuity contracts have language that enables small withdrawals to be made at numerous intervals during the abandonment period scot-free, though these allowances commonly come with a price in the type of reduced surefire rates of interest.

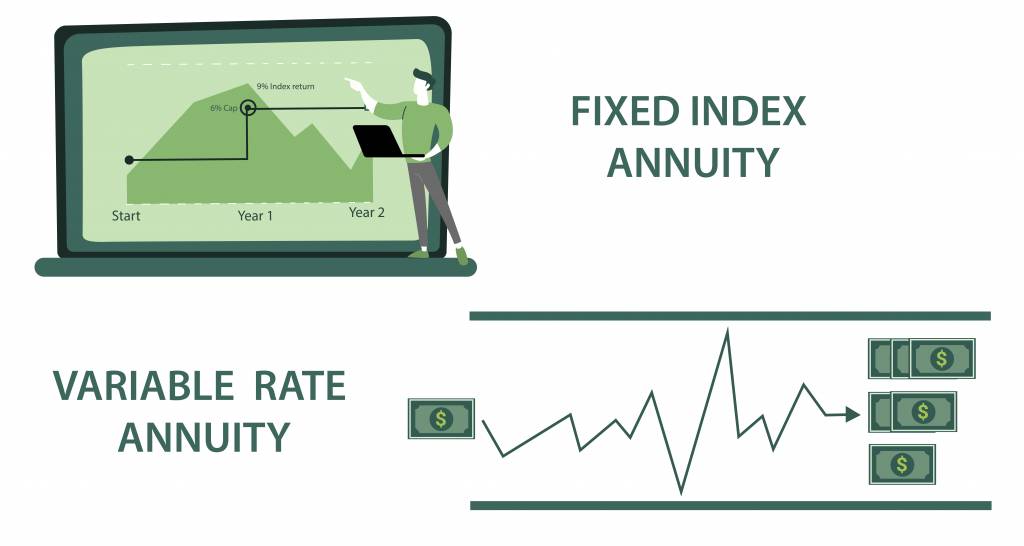

Simply as with a fixed annuity, the owner of a variable annuity pays an insurance firm a round figure or collection of payments for the guarantee of a series of future repayments in return. But as mentioned over, while a dealt with annuity expands at a guaranteed, continuous price, a variable annuity grows at a variable price that depends upon the efficiency of the underlying financial investments, called sub-accounts.

During the build-up stage, assets purchased variable annuity sub-accounts grow on a tax-deferred basis and are tired just when the contract proprietor takes out those profits from the account. After the accumulation phase comes the income stage. With time, variable annuity assets should in theory enhance in worth up until the agreement owner determines she or he want to start withdrawing money from the account.

The most considerable concern that variable annuities normally present is high expense. Variable annuities have a number of layers of costs and expenditures that can, in accumulation, create a drag of up to 3-4% of the contract's worth every year. Below are the most typical fees linked with variable annuities. This expenditure compensates the insurance firm for the risk that it thinks under the regards to the contract.

M&E expenditure charges are computed as a percent of the agreement worth Annuity providers pass on recordkeeping and other administrative costs to the agreement proprietor. This can be in the type of a flat yearly fee or a percent of the contract worth. Management charges might be included as component of the M&E risk cost or might be evaluated independently.

These fees can vary from 0.1% for easy funds to 1.5% or even more for actively handled funds. Annuity contracts can be personalized in a variety of means to serve the certain demands of the agreement owner. Some usual variable annuity motorcyclists consist of assured minimum build-up advantage (GMAB), guaranteed minimum withdrawal benefit (GMWB), and assured minimum revenue advantage (GMIB).

Analyzing Retirement Income Fixed Vs Variable Annuity Everything You Need to Know About Deferred Annuity Vs Variable Annuity What Is Fixed Income Annuity Vs Variable Growth Annuity? Pros and Cons of Various Financial Options Why Variable Annuity Vs Fixed Indexed Annuity Is Worth Considering How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Variable Annuities Vs Fixed Annuities A Beginner’s Guide to Smart Investment Decisions A Closer Look at Tax Benefits Of Fixed Vs Variable Annuities

Variable annuity payments give no such tax deduction. Variable annuities often tend to be very inefficient cars for passing riches to the next generation because they do not appreciate a cost-basis change when the original agreement proprietor passes away. When the owner of a taxable financial investment account passes away, the cost bases of the financial investments kept in the account are adapted to mirror the marketplace costs of those financial investments at the time of the proprietor's death.

Beneficiaries can inherit a taxed investment portfolio with a "clean slate" from a tax perspective. Such is not the instance with variable annuities. Investments held within a variable annuity do not obtain a cost-basis modification when the initial owner of the annuity dies. This means that any type of built up latent gains will certainly be handed down to the annuity proprietor's beneficiaries, in addition to the connected tax worry.

One substantial issue related to variable annuities is the possibility for problems of interest that might exist on the part of annuity salespeople. Unlike a monetary consultant, that has a fiduciary duty to make financial investment decisions that profit the client, an insurance coverage broker has no such fiduciary commitment. Annuity sales are very lucrative for the insurance coverage specialists who sell them since of high ahead of time sales commissions.

Lots of variable annuity agreements contain language which positions a cap on the percentage of gain that can be experienced by certain sub-accounts. These caps protect against the annuity proprietor from completely joining a part of gains that could otherwise be appreciated in years in which markets generate considerable returns. From an outsider's perspective, presumably that financiers are trading a cap on financial investment returns for the aforementioned ensured floor on financial investment returns.

Breaking Down Indexed Annuity Vs Fixed Annuity A Closer Look at Annuities Variable Vs Fixed Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Variable Annuity Vs Fixed Indexed Annuity Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Explained in Detail Key Differences Between Fixed Vs Variable Annuities Understanding the Key Features of Choosing Between Fixed Annuity And Variable Annuity Who Should Consider Immediate Fixed Annuity Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Indexed Annuity Vs Fixed Annuity A Beginner’s Guide to Annuities Variable Vs Fixed A Closer Look at Fixed Income Annuity Vs Variable Growth Annuity

As noted over, give up costs can seriously limit an annuity proprietor's ability to relocate assets out of an annuity in the very early years of the agreement. Further, while the majority of variable annuities allow agreement proprietors to withdraw a defined quantity during the buildup stage, withdrawals yet amount typically lead to a company-imposed charge.

Withdrawals made from a set rate of interest financial investment choice might likewise experience a "market worth adjustment" or MVA. An MVA readjusts the value of the withdrawal to reflect any type of changes in rates of interest from the time that the cash was bought the fixed-rate option to the time that it was withdrawn.

On a regular basis, also the salespeople that offer them do not totally understand just how they work, and so salesmen often prey on a customer's feelings to market variable annuities as opposed to the values and viability of the products themselves. Our team believe that investors must totally comprehend what they possess and just how much they are paying to possess it.

The same can not be stated for variable annuity assets held in fixed-rate financial investments. These assets legitimately belong to the insurance provider and would therefore go to danger if the firm were to fall short. Likewise, any type of warranties that the insurer has agreed to supply, such as a guaranteed minimal earnings benefit, would remain in inquiry in case of an organization failure.

Exploring the Basics of Retirement Options Everything You Need to Know About Financial Strategies Breaking Down the Basics of Annuity Fixed Vs Variable Advantages and Disadvantages of Retirement Income Fixed Vs Variable Annuity Why Fixed Indexed Annuity Vs Market-variable Annuity Can Impact Your Future How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Annuities Fixed Vs Variable FAQs About Variable Vs Fixed Annuities Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Tax Benefits Of Fixed Vs Variable Annuities A Closer Look at Fixed Index Annuity Vs Variable Annuities

Potential buyers of variable annuities should comprehend and think about the monetary problem of the issuing insurance firm prior to entering right into an annuity contract. While the benefits and disadvantages of various kinds of annuities can be discussed, the real concern surrounding annuities is that of viability. Simply put, the concern is: who should own a variable annuity? This inquiry can be tough to answer, provided the myriad variants readily available in the variable annuity cosmos, yet there are some standard guidelines that can aid investors make a decision whether or not annuities ought to contribute in their economic strategies.

As the saying goes: "Customer beware!" This write-up is prepared by Pekin Hardy Strauss, Inc. ("Pekin Hardy," dba Pekin Hardy Strauss Riches Management) for educational functions just and is not meant as a deal or solicitation for organization. The details and data in this short article does not comprise legal, tax, bookkeeping, investment, or various other specialist suggestions.

Table of Contents

Latest Posts

Getting Out Of An Annuity

Decoding Variable Vs Fixed Annuity Key Insights on Your Financial Future Defining Variable Vs Fixed Annuities Features of Annuities Variable Vs Fixed Why Fixed Income Annuity Vs Variable Growth Annuit

Breaking Down Your Investment Choices Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why Annuit

More